MeaTech goes south but shares in Just East Takeaway bounce on bumper sales

By John Reynolds on Friday 20 August 2021

By John Reynolds on Friday 20 August 2021

Shares in the Israeli cultured meat startup MeaTech were down after it reported losses of $6.7m in the first half of the year, though this was an improvement on the $13m loss the year before.

Shares in MeaTech were down 24.3 per cent to $5 (£3.67) after it reported an operating loss of $6.7m (£4.9m) in the first half of 2021, which was an improvement on the $13m (£9.55m) loss in the same period the year before.

R&D expenses and administrative expenses were cited as reasons for losses at MeaTech, the first cultured meat firm to be listed on the stock market.

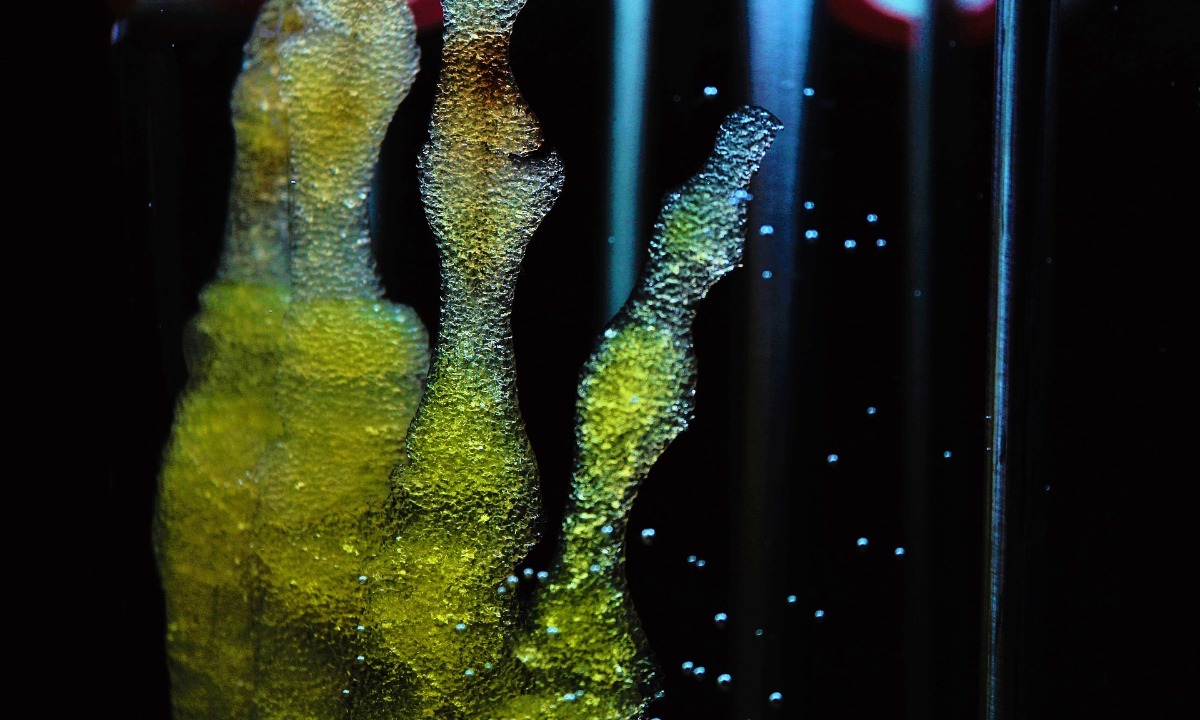

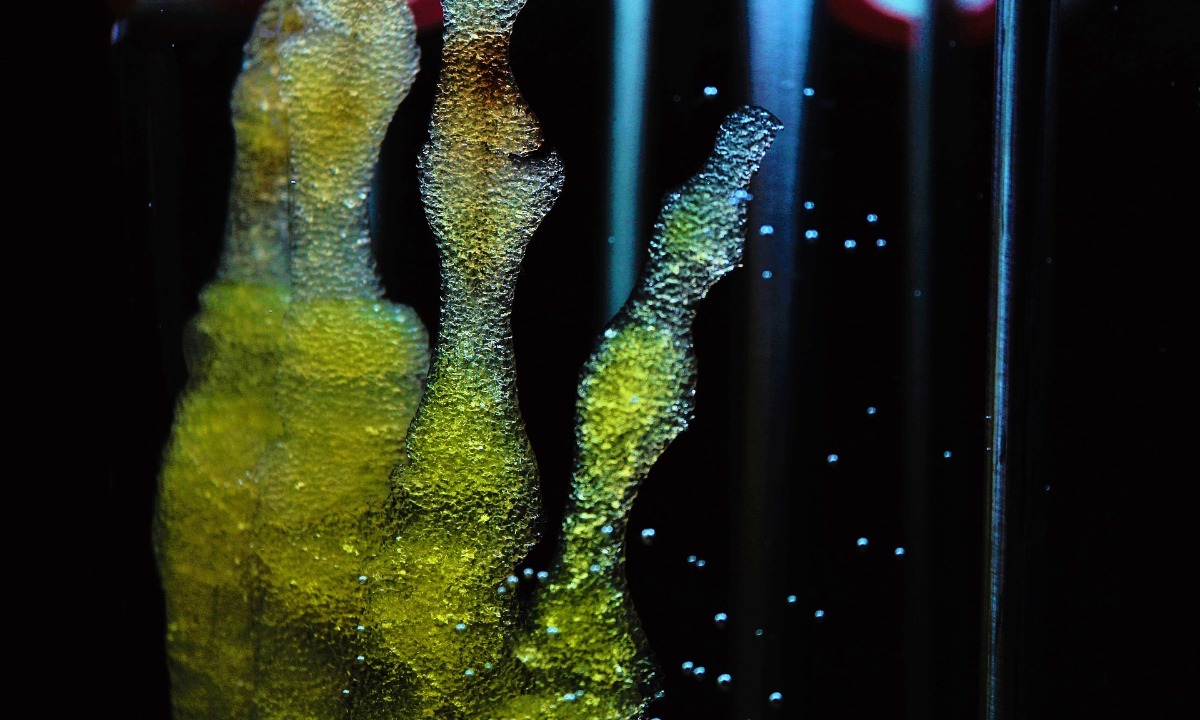

The long-term goal of the Israel-based firm is to produce real meat cuts, such as steak or chicken breast, using 3D bioprinting technology.

Using the technologies it gained from its $18m (£13.22m) Peace of Meat purchase last year, MeaTech is setting up a Belgian pilot plant and entering chicken fat production next year.

The firm has also begun research into the best way of scaling the 3D bioprinting of pork cells, which it believes could potentially "significantly expand its addressable markets".

Elsewhere shares in Just Eat Takeaway were up 9 per cent to 6,796p after its CEO Jitse Groen rejected a call from one of its largest investors Cat Rock Capital that it should sell off assets or consider a merger with a bigger rival.

Groen said a merger with a larger rival was “not absolutely logical at the moment” and that Just Eat would not be interested in talks with rivals that are “very loss-making”.

The CEO of Just Eat was speaking as Just Eat reported a 52 per cent leap in revenue to €2.6bn (£2.2bn) in the six months to the end of July.

However, pre-tax losses came in at €190m (£162m), compared with a €205m (£176m) profit a year earlier, after increased investment and rising staff and delivery costs.

Meanwhile, share in Ocado were up 0.63 per cent to 1,909.50p, despite Kantar figures showing sales at the online supermarket fell 0.7 per cent in the 12 weeks to August 8.

Kantar attributed the drop to the easing of Covid restrictions.

“Those who have come to love the convenience of an online shop are sticking with it,” Fraser McKevitt, Kantar’s head of retail and consumer insight said.

“But the unconverted are starting to drop away, preferring to get back to store instead.”

2 August 2021

Paul Cuatrecasas

13 September 2021

Paul Cuatrecasas

30 June 2021

Paul Cuatrecasas

9 September 2021

David Stevenson