Is FoodTech at risk of slipping into a bear market?

By David Stevenson on Thursday 7 October 2021

By David Stevenson on Thursday 7 October 2021

An analysis of recent returns for FoodTech businesses listed on the main stockmarkets reveals a worrying slide in values. Are investors losing interest or is the mix of FoodTech businesses all wrong?

Barely a day goes by now without some breathless article – or in the case of this week's Economist, a whole section – talking about the potential for FoodTech (and agTech) to revolutionise our eating habits. Paradoxically though this isn’t necessarily being translated into hard numbers on the main stockmarkets.

In fact, quite the opposite – numbers from this week show that many of the biggest stockmarket listed FoodTech names are in danger of quietly slipping into a bear market.

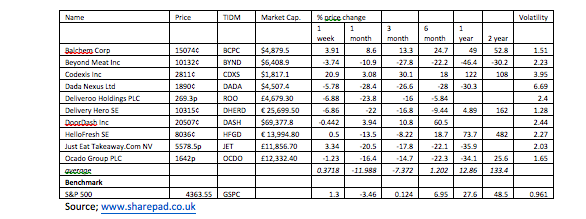

I’ve crunched data for the twelve biggest listed FoodTech companies by market cap, listed on the main developed world exchanges. This list of a dozen listed businesses will soon feature in a new stockmarket index and comprises a veritable who’s who of the public FoodTech scene.

Alongside obvious names such as Beyond Meat in alt proteins as well as DoorDash and Delivery Hero in the e-delivery space, this dozen also includes crucial enablers of the coming food revolution such as Balchem and Codexis

Over the month to October seven, 2021, these twelve stocks are down an average of around 12 per cent compared to a fall of just 3.4 per cent in the benchmark S&P 500 index. Most investors' definition of a bear market is for one or two months cumulative losses of between 15 per cent and 25 per cent.

Over three months these dozen stocks are down an average of 7.3 per cent compared with a small gain of 0.12 per cent for the DS&P 500 while over six months the gap is just as wide – FoodTechs are up a meagre 1.2 per cent against a gain of 6.95 per cent for the S&P 500.

It's only when we get to the two-year point that this gap vanishes – our 12 FoodTech giants are up an average of 133 per cent against 48.5 per cent for the S&P 500.

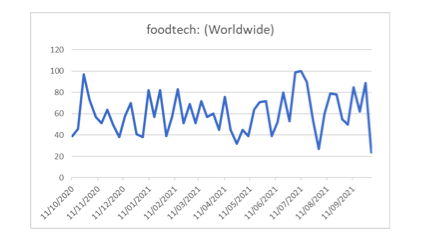

Another piece of the jigsaw comes from Google Trends data. In the graph below I’ve polled Google Trends for the term Foodtech – the results are surprisingly pedestrian. Anyone expecting a boom in online search queries will be sorely disappointed. And just in case you were wondering whether search terms such as alternative proteins score any better, they don’t.

The paradox here is that we can see the enthusiasm building in one isolated example – the share price of London-listed FoodTech venture capital fund Agronomics. At 26.5p, Agronomics share price is up 10.4 per cent over the last month, and up 430 per cent over the last 12 months (all to October six).

And if we measure mainstream media interest, interest in FoodTech is definitely massively increased with endless deep dive features and special reports in all the main channels.

So, what’s going on? Why are the public markets slightly souring on FoodTech while mainstream media channels (and Agronomics) report massively increased interest?

One obvious factor is that my 12 top stocks is heavily influenced by the food delivery technology sector which was an obvious beneficiary of the lockdown. Now that consumers are out and about shopping again, interest has certainly waned – and competition between major players intensified.

Another factor is that the listed FoodTech space is currently rather ‘lopsided’ – its bias is towards cash generative, already in the market names such as Delivery Hero or DoorDash. These businesses have very little to prove except whether they can produce generous profit margins.

By contrast, much of the excitement within the FoodTech space is actually focused on more pioneering product categories such as cultured meat, or new AgTech products or even plant biotech.

These sub-sectors dominate venture capital fund flows but aren’t really represented in the public markets with the exception of plant-based meat alternatives (Beyond Meat) and vertical farming (AppHarvest). Agronomics, the London listed investment fund, is by contrast very much focussed on these earlier stage, pioneering markets (especially cultured meat) which perhaps helps explain its relative share price strength.

The big question is whether the window for earlier stage IPOs and SPACs will stay open long enough to allow for a steady stream of these now privately owned pioneers to list on the public markets?

My finger in the air guess is that equity markets will probably remain in muted but bullish mood for another few months allowing for a steady stream of new listings.

But the inevitable big bear is coming i.e a full, market-wide sell off.

At that point the window for new listings will close for at least a year or two. The race now is for the FoodTech sector to mature and broaden out before that inevitable sell off hits all of us!

2 August 2021

Paul Cuatrecasas

13 September 2021

Paul Cuatrecasas

30 June 2021

Paul Cuatrecasas

9 September 2021

David Stevenson