Best of the web November

By David Stevenson on Thursday 2 December 2021

By David Stevenson on Thursday 2 December 2021

Our monthly round-up of the best sector articles from the rest of the internet.

Formerly known as Memphis Metas says Emeryville facility - a 53,000 square foot campus that is “designed to produce any species of meat, poultry, and seafood” in ground and whole-cut form - can produce “over 50,000 pounds of finished product” with a future capacity of over 400,000 pounds per year.

There are now cultivated meat companies on every continent except Antarctica, but they are not distributed equally. At 40%, North America has the most producers by far. The continent also has a disproportionately high (57%) share of investments. This has led to speculation that the USA could be the next country to grant regulatory approval to cultivated meat, with rumours that this is already in progress.

Now, it’s issuing an Innovation Call to invite startups, researchers, corporations and NGOs to join its journey to co-develop new ways to leverage fungi as a source of climate-resilient protein. It’s never been more clear that the world’s food system needs to change. Globally, food production accounts for a third of global emissions—and at the centre of it is animal protein. Livestock farming drives nearly a fifth of all GHGs, more than all transportation combined. That’s why Novozymes is betting on mycoprotein, which it believes is one of the most promising alternative protein solutions for a climate-resilient food system.

https://www.greenqueen.com.hk/novozymes-mycoprotein-innovation-call/

Beyond Meat isn't the only publicly traded company to see recent problems. Canadian meat giant Maple Leaf Foods showed disappointing sales for its plant-based division during the last two quarters, and is conducting a full review. Kellogg's MorningStar Farms brand also has experienced a sales slowdown in the last quarter

JBS is entering the cultivated meat space through the acquisition of Spain's BioTech Foods and a $100 million investment in facilities. The global meat giant's funds will build both a new production plant in Spain for BioTech Foods and a cultivated meat research and development center in its home country of Brazil.

and

https://plantbasednews.org/news/economics/meat-processor-cultured-market/

and

Alpro‘s $23 million upgrade project in Kettering plant includes the installation of a new high-speed manufacturing line capable of processing 300 million litres of plant-based beverages per year, with further plans to increase its capacity to 400 million litres in 2022, as reported by The Grocer.

The organisations are building “a new cloud-based set of digital tools and data science solutions for use in agriculture and adjacent industries, bringing new infrastructure and foundational capabilities to accelerate innovation, boost efficiency, and support sustainability across value chains.” This new “off-the-shelf infrastructure” could be licensed by startups as well as large, global enterprises, for use in their own “farming operations, sustainable sourcing, manufacturing and supply chain improvement, and ESG monitoring and measurement” offerings, the companies said.

Uber Eats states that orders of vegan menu items have rocketed by 1436% in the UK since 2018 and reveals a 59% rise in restaurants with vegan options. Meanwhile, fellow food delivery service Deliveroo reports a 105% spike in vegan orders this year. Deliveroo states that there are now over 14,000 vegan and vegan-friendly restaurants on the app, making it one of the fastest-growing categories on the platform, with most vegan orders coming from Brighton, Bristol and Leeds. The app carried out a survey which found that 20% of Brits are planning a meat-free meal this Christmas

US indoor farming company Local Bounti has completed its merger with special purpose acquisition company (SPAC) Leo Holdings III Corp, which is listed on the New York Stock Exchange (NYSE). As a result of the deal, which completed November 22, Leo was renamed Local Bounti and switched to trading under the ticker symbol ‘LOCL.’

Canadian plant-based food company and sesame milk manufacturer The Planting Hope Co. has completed its initial public offering (IPO) in Canada, selling 22.5 million shares at $0.40 apiece. These shares are now trading on the TSX Venture Exchange under the stock ticker “MYLK,” according to an official news release from the company.

https://www.greenqueen.com.hk/sesame-milk-planting-hope-cse/?mc_cid=d10e8456c9&mc_eid=c50da91d11

Vejii, the largest sustainability-focused online marketplace in North America, announces it has become publicly listed on the CSE under the ticker VEJI. The platform, which delivers to 48 states, today becomes one of the few plant-based companies in the world to go public.

and

The alt-meat darling continues to over-promise and under-deliver, though defenders still back CEO Ethan Brown’s vision

Agronomics currently is in advanced discussions to make investments of up to US$52 million in 6 new and existing portfolio companies covering category leaders in both cell culture and fermentation technologies and spanning the range from pre-seed to series B. In addition to these very near-term opportunities, the Company has a significant pipeline of additional identified leads and expected funding rounds for existing portfolio companies.

https://polaris.brighterir.com/public/agronomics/news/rns/story/w0me3zx

The investment is for an equity stake on a fully diluted basis of 1.39%, which will equate to an estimated portfolio weighting of 5.7%. It is part of a $127.5 million fundraise by EVERY, which uses precision fermentation to produce proteins such as egg protein and pepsin that are traditionally derived from animals.

Third quarter year-over-year consolidated revenues increased 13% as reported and 35%, as adjusted for the divested barley business, to $32 million. Ingredients segment revenues were $23.1 million, an increase of 34% as reported and 80%, as adjusted for the divested barley business.

https://bensonhill.com/2021/11/15/benson-hill-announces-third-quarter-2021-financial-results/

VERY GOOD had a record month in October with C$1.5 million in revenue from its eCommerce and retail channels.

Plant-based dairy alternative company bettermoo(d) announces the completion of its Moodrink and reveals its upcoming product launches. Furthermore, bettermoo(d) announces the signature of an agreement with Happy Supplements Inc., for a potential public transaction that would result in the Company shares being listed on the Canadian securities exchange. Upon successful negotiations and mutual agreement, the company is poised to complete the major transaction, whereby Happy Supplements would acquire all the outstanding share capital of bettermoo(d) for consideration of 9 million shares and 10 million warrants in Happy Supplements.

and

The S-1 released by Sweetgreen earlier this week reveals a business that does have a growth story to tell, but one that comes at a steep cost. Last year, Sweetgreen lost $142 million on revenue of $220 million in 2020. The loss was more than double the $67 million it reported for 2019.

The Midwest farm and construction equipment maker posted annual net income of nearly $6 billion, more than double the $2.8 billion it earned a year earlier and easily clearing its previous fiscal year record earnings of $3.5 billion reached in 2013. The company said it anticipates earning between $6.5 billion to $7 billion in the current fiscal year.

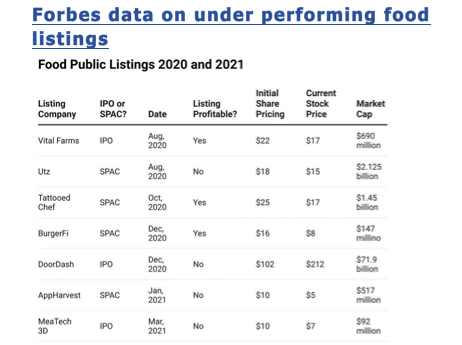

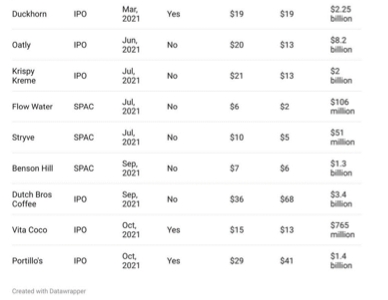

Shares of Oatly (OTLY) tanked by almost 20% on Monday (November 15), after the company’s sales forecast saw a downward revision. Compared to its stock market debut in May, the share price is down nearly 60%. Sales are projected to come in at around $635 million for the year, a reduction from its previous prediction of $690 million. The Swedish oat milk brand recorded just over $171 million in Q3 revenues in the, missing the consensus target of $185 million, based on Bloomberg data.

https://www.greenqueen.com.hk/oatly-shares-drop/?ct=t%28OCT+8+2020+INDUSTRY+SCOOP_COPY_01%29

Developed by Singapore-based Sophie’s BioNutrients and the US ingredient giant Ingredion, the new dairy-free microalgae cheese not only tastes tangy and melts like the real deal, but is also loaded with vitamin B12.

The new egg, called The Boiled, is the latest from the company’s plant-based product line, V-Love. According to the announcement, The Boiled is made with fourteen different ingredients but gets its protein punch from soy. The alt-egg will be on sale this month in stores across Switzerland in four-packs and will retail for 4.40 Swiss Francs

Cultivated fat maker Mission Barns partnered with California-based Silva Sausage to create a plant protein sausage using cultivated fat. Through the partnership, the companies completed a scaled-up manufacturing run of the new Mission Chorizo Sausage.

The Teredine Project extracts cells from leaves and uses them to grow wood-like cells, which are then cultured in a liquid growth medium. After they have proliferated, the cells are moved to a hydrogel that acts as a 3D-printed scaffold to make them grow into the desired shape. Geneusbiotech points out that the cycle of growing, harvesting, and transforming wood into objects is extremely resource-intensive and creates a significant amount of waste. 3D printing the finished product using cultivated wood could eliminate this process.

Cajú Love just created the first cashew fruit meat introduced to the US market. Instead of using typical plant protein ingredients such as soybeans or wheat, the Honolulu-based company’s whole food clean label vegan meat is made from cashew fruit that would otherwise be food waste.

Nuritas says its AI and genomics-powered platform, called NπÏ• (a Hellenized initialism of ‘Nuritas Peptide Finder’), can analyze billions of peptides found in plants and natural food sources at speed, and predict how they will impact human health. With these findings, the Dublin-based startup creates supplements in powdered form that can be added to foods, beverages, and personal care products to unlock additional health benefits for consumers.

According to Crunchbase data1, in 2018 and 2019 venture capitalists invested more than $4 billion into the AgTech space, with recent funding not showing any signs of decline.

Californian agtech startup Farmers Business Network (FBN) has raised $300 million in Series G funding at a valuation just shy of $4 billion. That’s more than double its valuation in August 2020 when FBN, which is both a fintech marketplace for farmers and a data analytics platform for online grain and inputs, raised $250 million. It’s also reflective of the growth in FBN’s farmer network during the same 15-month timeframe, from 12,000 farms to 33,500 across the US, Canada, and Australia.

he acquisition will add a layer of autonomous driving capabilities to Fieldin’s sensor-based farm management platform, providing more efficiency when it comes to day-to-day tasks on the farm, the company said. Founded in Haifa, Israel in 2013, Fieldin has since expanded to the US and Australia. It claims to be the largest ‘smart farm management’ company in the US, with 30% of the country’s lettuce crop — and 20% of the world’s almond crop — running through its platform.

The pea protein market grew at a 6.4% CAGR between 2016 and 2020. Increasing awareness regarding the benefits of pea protein ingredients has accelerated the sales to be poised to total US$ 1.25 Bn in 2021.

and why Novo Farina thinks texturized protein from locally grown yellow peas is the next big thing

Chinese agrifoodtech VC firm Bits x Bites has closed its latest fund on $100 million with a string of food and ag corporates as well as investment players signing up as LPs. Among those participating in the fund’s final close were Syngenta Group Ventures, the VC arm of Syngenta; animal nutrition company Adisseo; Cavallo Ventures, the VC arm of Wilbur-Ellis; DisruptAD, the venture platform of UAE government-linked investor ADQ; and specialist equipment maker and manufacturing services provider Esco Lifesciences.

US agricultural cooperatives CHS and Growmark have combined forces to establish a VC fund that will invest in “breakthrough technologies” that can advance the farming industry, they announced today. Both companies will be equal partners in the fund, which has $50 million in capital. Named Cooperative Ventures, the operationally independent vehicle will seek out startups that demonstrate a “strategic fit” with CHS’s and Growmark’s broader activities. It will primarily look for opportunities in three core investment areas: crop production, supply chain, and sustainability.

New data released by The Good Food Institute Asia Pacific (GFI APAC) reveals that 2020 saw a stunning $3.1 billion (USD) in investments in companies creating sustainable alternatives to conventional animal-based foods, including plant-based meat, egg, and dairy companies; cultivated meat companies; and fermentation companies devoted to alternative proteins.

ReGen Ventures, the Australian-American early-stage venture fund has announced the close of its $50 million first fund. The capital will be used to partner with companies with a focus on regenerative tech to actively restore climate, planetary, and human health. ReGen Ventures’ portfolio includes Hide Biotech, a company producing cow-free leather from food waste. Leveraging state-of-the-art protein chemistry and bioengineering technologies, Hide Biotech obtains collagen – the fundamental protein of skin structure – and reassembles it into a biomaterial using patented technologies.

At the end of 2020, there were more than 70 startups across the globe working on making meat, seafood, and animal fat and organs from cells, according to the Good Food Institute. As of the end of last year, these companies, which all aim to serve meat without slaughtering animals, received more than $350 million from investors to work on R&D, build facilities, hire employees and expand their reach.

But years of research on the environmental impact of food make one thing clear: Plant proteins, even if processed into imitation burgers, have smaller climate, water, and land impacts than conventional meats. Apart from environmental impact, reducing meat production would also reduce animal suffering and the risk of both animal-borne disease and antibiotic resistance.

Bowery plans to open the Bethlehem farm sometime this year or in 2022—and meanwhile, they’re expanding in other ways. The company has doubled its revenue this year. Its products are sold in over eight times as many stores as they were last January.

Gene editing has a large role to play in improving the way we produce our food, as well as in building a more equitable food system, particularly now that investments are starting to reflect the shifting expectations of corporate citizenship. (See Finistere Ventures’ 2020 AgriFood Tech Investment Review.) We may finally see adequate financing and adoption of gene editing technologies in agriculture

Impossible Foods has secured $500 million in a new funding round led by existing investor Mirae Asset Global Investments. Other existing investors, unnamed at this time, also participated. It brings the US company’s total funding “close to $2 billion,” according to a press release, and values the company at $7 billion

and

and founder says IPO inevitable

Announces $12 million Series A funding to expand its product line of nutrient-dense foods created for children up to seven years old. The investment comes 18 months after a $2 million seed round and growth that had the company going from from 100 to 1,000 stores.

https://techcrunch.com/2021/11/19/foodtech-amara-infant/?mc_cid=d10e8456c9&mc_eid=c50da91d11

Helaina created its first protein and now wants to create all of breast milk’s components, though one at a time. Not only will its product provide calories, but also it will help to build immunity against fungal, bacterial and viral diseases. The company’s latest round was co-led by Spark Capital and Siam Capital, and includes Plum Alley Investments and Primary Venture Partners. It gives the company $24.6 million in total funding

Aqua Cultured Foods, a US company that makes seafood analogs via a fermentation process, has raised $2.1 million in pre-seed funding.

Shiru develops novel plant-based food ingredients using machine-learning algorithms and precision biofermentation. Shiru’s technology allows food companies to incorporate next-generation plant-based proteins without in-house biotech facilities. Closed a $17m Series A

and

Daring is also positioning itself as a cleaner product—both to conventional chicken and to the other vegan chicken options on the market; it uses five ingredients compared to competing products that can contain as many as 40 ingredients. The product is also high in protein and lower in calories than conventional chicken.

In 2019, the company came out with its first product, Kelp Jerky, which comes in four flavors, and was a product Boyd Myers thought would be a good trial run to help people see ocean-farmed kelp in a new way. “It was hit-or-miss, but is very healthy,” she added. “We went back to the drawing board during the pandemic on a new product and invented The Kelp Burger.”

and

The round was led by Kinnevik, Ambrosia and Temasek. Gullspang also participated in this round. The company will use the money to bolster its North American and European growth by expanding its portfolio and doubling store count next year. Nick's also plans significant R&D investments. This is the second big funding round this year for Nick's. In January, the company raised $30 million to fuel its international expansion efforts.

TurtleTree Labs, a Singaporean company developing cell-based milk products, has raised $30 million in the first tranche of its Series A funding round. The round was led by VERSO Capital. TurtleTree says the funding will be used to expand its portfolio, hire new talent, and further develop its technology. The company, which was the first ever to create milk from cells, is aiming to scale up its research and production of the ingredients found in human milk.

and

Shiok says that the funding will help the startup race ahead towards its goal of commercialising cell-based seafood by 2023, a plan it set out previously during its initial bridge round close.

With the company now valued at $400 million, the latest funding brings Future Farm’s total investment raised to $89 million. The Series C funding will be used to expand Future Farm’s range of plant-based meat substitutes into more retail outlets internationally, as well as develop its entire range. This will include the future addition of plant-based dairy products, including a butter alternative.

and

2 August 2021

Paul Cuatrecasas

13 September 2021

Paul Cuatrecasas

30 June 2021

Paul Cuatrecasas

9 September 2021

David Stevenson