Alt-proteins: a meaty issue

By Frank Buhagiar on Wednesday 7 December 2022

By Frank Buhagiar on Wednesday 7 December 2022

An in depth look into the world of alt-proteins.

What is it?

Question: who said the following and when?

“We shall escape the absurdity of growing a whole chicken in order to eat a breast or a wing, by growing these parts separately under a suitable medium…The new foods will be practically indistinguishable from the natural products from the outset, and any changes will be so gradual as to escape observation.”

Answer: Winston Churchill in 1931

Almost one century on and Churchill’s vision has never been closer to becoming reality.

That’s because there is a plethora of companies that have successfully grown various cuts of different types of meat in laboratories all around the world. The end product is identical to conventional meat in terms of taste and texture…it is meat after all just grown in a lab rather than in a field or in the sea. What’s more lab meat promises added benefits – it has the potential to be ecologically and ethically superior to conventional meat.

The Problem

Just as well…because the traditional meat industry is caught between a rock and a hard place. On the one hand the industry has to do its bit to tackle climate change and transform into a more sustainable model. On the other hand, it has to meet rising demand for protein.

The use of the word ‘bit’ to describe the role the meat industry can play in fighting global warming is misleading. For it needs to do a lot. Livestock production is among the leading anthropogenic sources of methane which, according to the UN’s Intergovernmental Panel on Climate Change (IPCC), has 87 times the warming potential of CO2. Animal farming’s contribution to global greenhouse gas emissions (GHG) is estimated at 15%.

Livestock production’s issues do not begin and end with GHG emissions. It has also been estimated that 60% of the loss in global biodiversity is down to animal farming, that 33% of global arable land is used for livestock feed production and that 46% of the global harvest is used as livestock feed. The traditional meat industry has a large environmental hoofprint.

To look at it another way, if livestock production were to be halved, it is estimated that 12,000 species would be saved, yearly biodiversity losses would fall by 30% and 4.45 million sq km of arable land, equivalent to the size of India and Mongolia combined, would be reclaimed.

It’s not just animal farming doing the harming. Aquaculture has similarly grim statistics. Overfishing has already caused a 90% decrease in the population of all large predatory fish including tuna, sharks, swordfish, cod and halibut. 90% is also the percentage of edible fish stocks that are considered to be maximally exploited or overfished, contributing to a total collapse of c. 13% of global fisheries. Overfishing, destruction of marine ecosystems, climate change, ocean acidification – all have been cited as reasons why fish farming, as we know it, is unsustainable in the long term.

What’s more the health concerns are not restricted to the environment and animals, but humans too. The animal protein industry uses antibiotics to prevent livestock epidemics but this triggers antibiotic resistance among humans, causing major health risks. Animal farming has also been linked to outbreaks of zoonotic diseases such as swine flu, avian flu and COVID-19.

Whether it is climate change, loss of biodiversity, or human health concerns – there is a price to pay with traditional livestock/fish production. How much? Well, we may soon find out if talk of imposing a “carbon tax” on the traditional meat industry is put into action. A tax would just be the latest in a long line of problems facing animal farming. A solution is needed.

The Solution

Enter alternative proteins.

Like disruptive technologies/solutions that have transformed other industries, alt-protein has had a number of iterations. In 2010, a first-generation solution appeared on the scene – plant-based alt-meat. Derived from sources such as grains and legumes, plant-based products imitate conventional meat in terms of taste, texture, smell and appearance. Based on the appearance of plant-based brands, such as Beyond Meat and Impossible Foods, on supermarket shelves or fast-food chain menus, alt-protein 1.0 has come a long way in relatively short space of time.

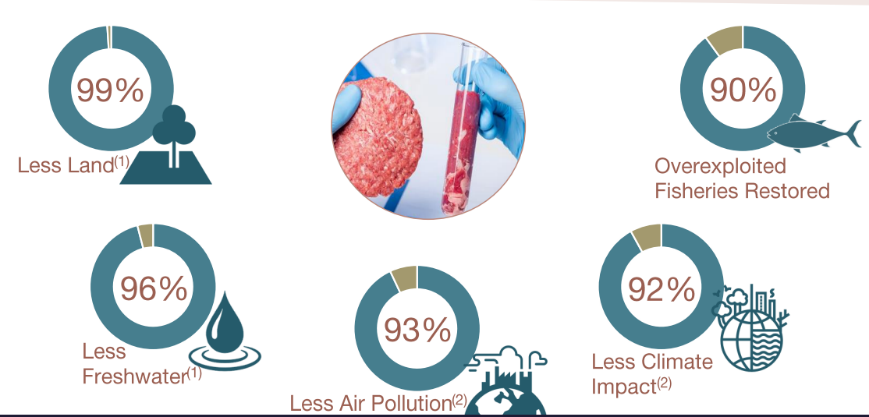

Now a second-generation solution is looking to build on the progress made by the plant-based brands. As the graphic below shows, lab meat / fish promise to solve an array of conventional meat’s economic and sustainability issues:

How does it work?

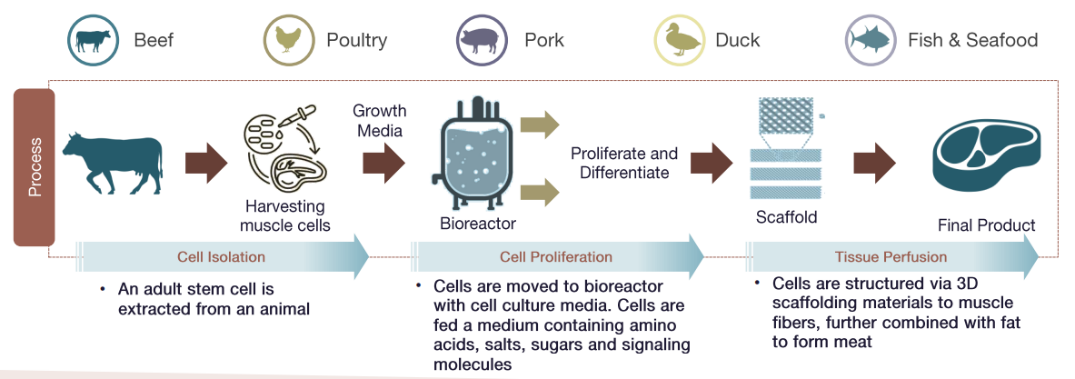

Lab or cultivated meat involves growing edible tissue in vitro from animal stem cells using tissue engineering techniques.

As explained by the Good Food Institute: “The manufacturing process begins with acquiring and banking stem cells from an animal. These cells are then grown in bioreactors (known colloquially as cultivators) at high densities and volumes. Similar to what happens inside an animal’s body, the cells are fed an oxygen-rich cell culture medium made up of basic nutrients such as amino acids, glucose, vitamins, and inorganic salts, and supplemented with proteins and other growth factors.

“Changes in the medium composition, often in tandem with cues from a scaffolding structure, trigger immature cells to differentiate into the skeletal muscle, fat, and connective tissues that make up meat. The differentiated cells are then harvested, prepared, and packaged into final products. This process is expected to take between 2-8 weeks, depending on what kind of meat is being cultivated.”

In episode 13 of FFF’s podcast series, “Steakholder Foods’ Secret Sauce”, CEO Arif Kaufman gave a brief run-through of the processes and techniques deployed by his company to cultivate meat in a lab. Once stem cells have been collected and differentiated into muscle and fat, they are proliferated to create biomass. This can then be either added to plant-based products to create a hybrid product or loaded into a 3D printer. The resulting printed product is placed in an incubator and as Kaufman says, “After a few weeks you have 100%-cultured meat products that you can eat.”

Kaufman goes on to say that Steakholder Foods already has “a product that emphasises…our technological capabilities, the Omakase Beef Morsels which is a 100%-cultured meat product with very nice muscle alignment”.

Timeline – the past and the future

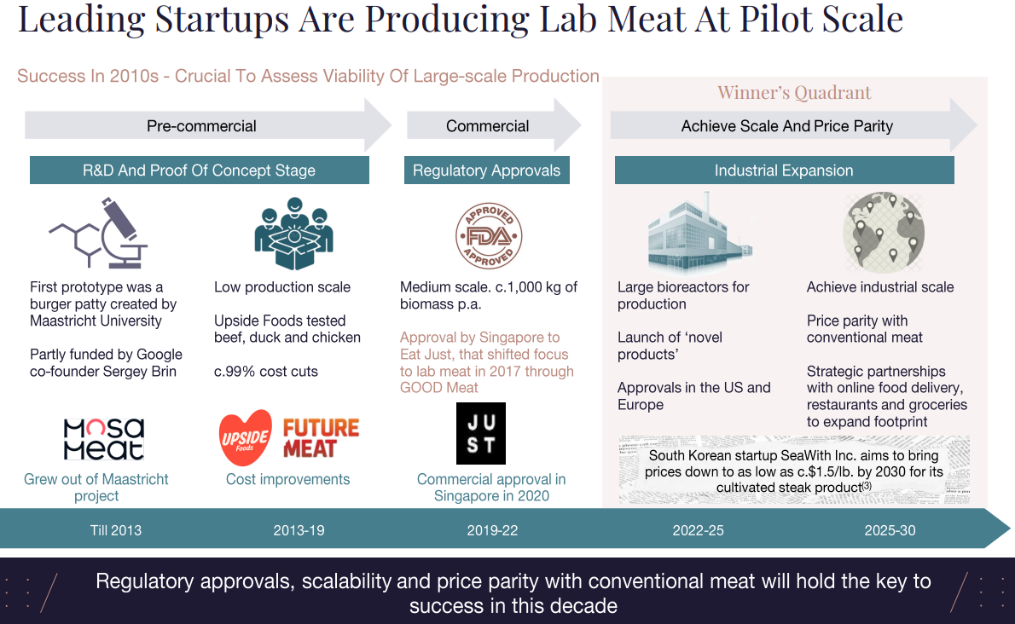

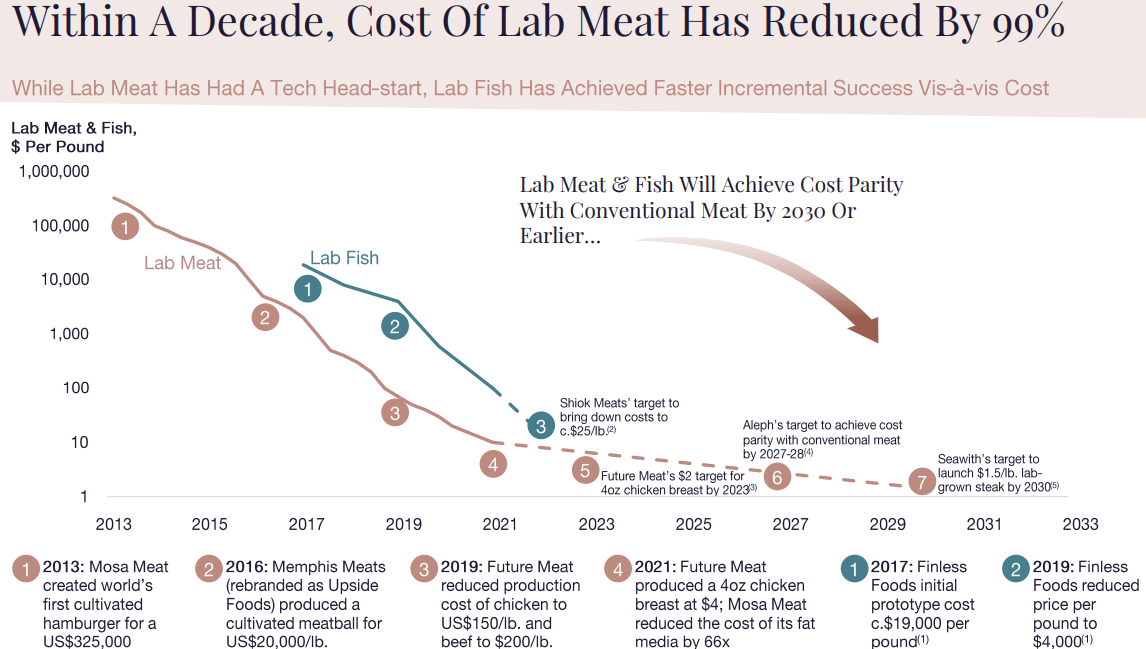

Lab meat has come along way since Mark Post, a researcher at the University of Maastricht and co-founder of Mosa Meat, revealed the first cultivated meat burger in 2013. Since then, costs of production have fallen considerably, scalability has been ramped up and first regulatory approvals have been granted – in December 2020, the Singapore Food Agency approved commercial sales of California-based Eat Just’s cultivated chicken product. This was soon followed by another first - the first commercial sale of Eat Just’s cultivated chicken product at the 1880 restaurant in Singapore.

More recently, Upside Foods received FDA approval for its lab-grown chicken, the first regulatory approval for cultivated meat in the US.

Despite the progress made, there is still a long way to go before cultivated meat products are regularly consumed around the world. Challenges include: regulatory approvals, scalability and price parity with conventional meat. The below graphics provide a timeline for milestones hit to date and those that still need to be met. First lab meat…

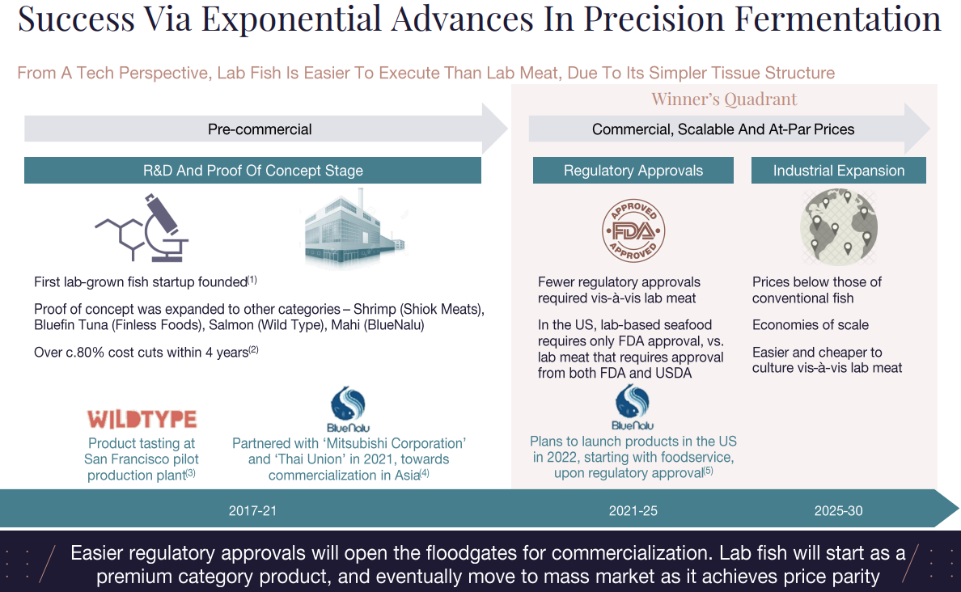

…and then lab fish

An obstacle

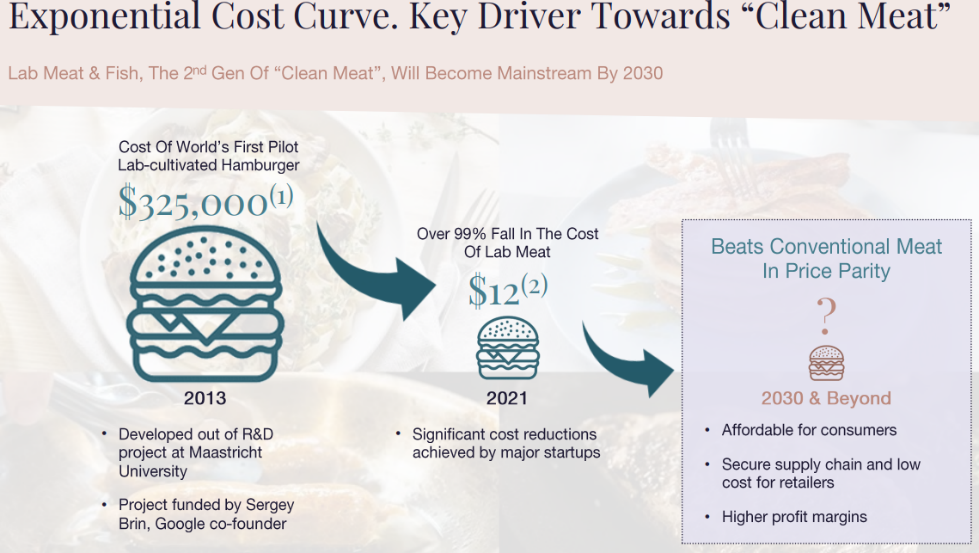

The above graphic touched on one of the biggest obstacles lab meat needs to overcome - cost. In 2013, when Mark Post was unveiling his cultured burger, it cost US$325,000 to produce one pound of lab meat. That’s one expensive burger. To move from expensive prototypes to commercial sales, the industry needed to bring down costs.

It has. Like so many new technologies, the “clean meat” industry is benefiting from an exponential cost curve that has seen a 99% reduction in the cost of production in the last decade. By 2021, the cost to produce one pound of lab meat had fallen to US$20-30. Still a way to go. It is expected, however, that lab meat will achieve cost parity with conventional meant by 2030 or earlier. As Steakholder’s Kaufman told FFF: “…creating a 100%-cultured meat product is not cost effective yet…but we see costs reducing all the time.”

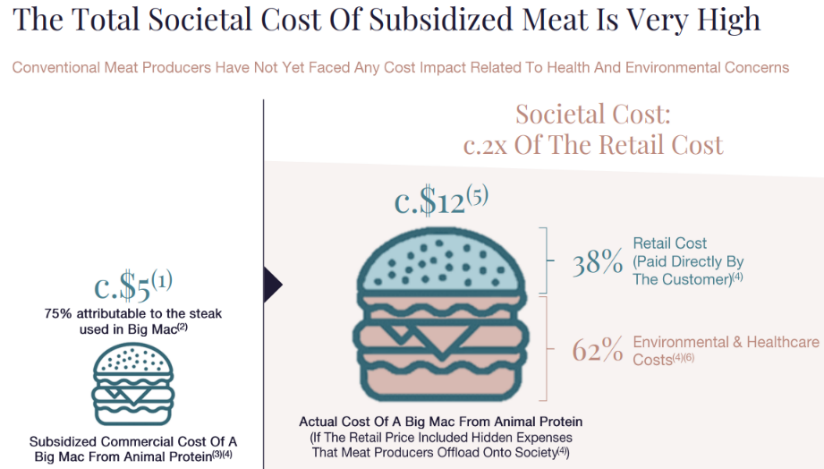

Then there is the other side of the equation. The cost of traditional meat could rise in the future, particularly if a mooted traditional meat carbon tax becomes a reality. For meat is being sold to consumers at just a fraction of what it would cost if it accurately reflected the true value of the traditional meat industry’s environmental footprint. The total cost of conventional meat is not simply financial. There are societal costs too. To date, conventional meat has fully externalised these. If they were internalised, traditional meat would become a lot more expensive.

According to the Oxford Martin Programme, a global average tax of 40% on meat is necessary to offset the carbon footprint of the animal agriculture industry. And a meat tax is closer to reality than readers might think - in Germany an increase in VAT on meat to 19% from 7% has been proposed.

Why now?

Price parity or near-price parity has been key to the take-up of disruptive technologies in other industries. Clean energy, such as wind and solar, for example, had been around for years, but it only made meaningful inroads into the global energy mix once the cost of production fell to within touching distance of energy produced from fossil fuels. Similar to clean energy, clean (alt) meat is set to disrupt the traditional meat industry on the back of exponentially falling costs in the production of lab meat and fish.

The key is scaling up production. As the graphic below shows though, lab meat / fish has already successfully lowered per unit costs by 99% over the last decade and is on course to achieve cost parity by 2030 or sooner. At this point, alt-meat can look to take chunks out of what it is a sizeable market.

Size of market

According to a press release put out by the Business Research Company in November 2022, the value of the global meat market, which includes poultry and seafood, currently stands at US$1.47 trillion, an increase of 8% on 2021’s US$1.36 trillion. Furthermore, BRC writes: “The meat, poultry and seafood market is expected to grow to $1.84 trillion in 2026 at a CAGR of 5.7%.”

Among the growth drivers cited “…the increased demand for quality and sustainability will support the growth of the meat, poultry, and seafood market. A growing group of consumers is prepared to spend more on meat from animals that have been kept in better conditions. Sales of meat from free-range and organic chickens are on the rise, and the same trend can be seen with free-range and organic eggs.” The BRC press release goes on to say: “Cultured meat is an emerging trend gaining popularity in the meat, poultry and seafood market.”

The press release ends with a reference to climate change: “An increase in animal agriculture for meat production releases a high amount of methane gas which contributes to global warming. Following this, several government organizations raised awareness on the harmful effects of animal agriculture to meet the demand for meat, urging people to switch to vegetarian diet forms.”

Who are the leading players?

Below are just a few of the innovators and rising stars that are driving the cultivated meat sector forwards:

In recent years, some of the more established players in the food industry such as Cargill and Nestle have started investing in the alt-meat space too:

Final word from the alt-protein visionary

For lab meat to emulate and improve upon the success of plant-based alternatives, regulatory approvals, cost parity with conventional meat and fish, product innovation and scalability will all be required.

Even then, the lab meat start-ups and the bigger players trying to muscle in will likely still have a lot to do to persuade consumers to swap their field-grown meat feasts for lab-grown ones. The road will unlikely be smooth.

Perhaps, they will need to take on board advice given by the alt-protein visionary that was Winston Churchill: “Success is the ability to go from failure to another without loss of enthusiasm.”

2 August 2021

Paul Cuatrecasas

13 September 2021

Paul Cuatrecasas

30 June 2021

Paul Cuatrecasas

9 September 2021

David Stevenson